JAMFIN Workshops

Join JAMFIN Today!Support Young Entrepreneurs!Explore Green Business Funding!Connect for Economic Growth!

Our workshops empower our members with information on fulfilling the financial needs and direction on providing valuable and accessible products and services to satisfy their customers, positioning JAMFIN as an umbrella organization for collaborative growth within the micro-enterprise sector.

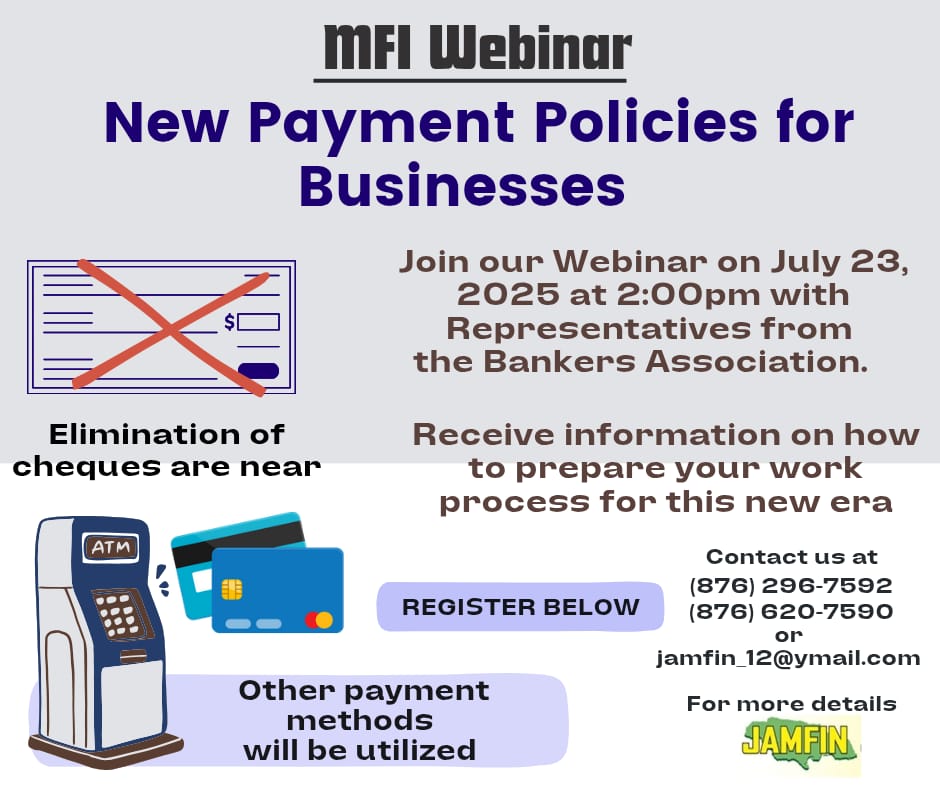

New Payment for Policies for Businesses

When: Jul 23, 2025 02:00 PM Bogota

Register in advance for this meeting: Copy and paste the link in another browser

https://us06web.zoom.us/meeting/register/1cWD7I8hRjWc6kRucKNS1Q#/registration

After registering, you will receive a confirmation email containing information about joining the meeting.

ABOUT US

OBJECTIVE

valuable and accessible products and services to satisfy the short-term and long-term financial needs of our customers.

What we Do ?

The Association is mindful that micro enterprises vary in nature and are relevant for a broad cross section of economic activity, Young entrepreneurs for example, are our future business leaders and decision makers. They hold the key to the sustainable development of the world’s economy, hence, young people have to be encouraged and taught to recognize entrepreneurship as a viable career choice, the micro financing sector sees these young people as an important segment of their market.

Jamaica Association of Micro Financing Limited (JAMFIN)

- Adress: 21 Connolley Avenue, Kingston 4, Jamaica

- Phone: 876-620-7590, 876-296-7592

- Email: jamfin_12@ymail.com

WORKSHOP2025

JAMFIN: Nurturing Micro-Enterprises, Igniting Growth Together!

January 2024

Financial Literacy Bootcamp:

January 2024

March 2024

Green Business Symposium

Explore sustainable business practices in agriculture, manufacturing, and tourism. This workshop focuses on eco-friendly initiatives, renewable energy adoption, and sustainable methodologies. Participants will learn how to integrate green practices into their operations, aligning their businesses with environmentally conscious trends

July 2024

Youth Entrepreneurship Summit

July 2024

August 2024

Digital Marketing Masterclass

SKILLS

Teaching these skills is fundamental to JAMFIN's mission of supporting the development of the micro-enterprise sector as a key player in national economic development. Each skill addresses specific challenges and opportunities that micro-entrepreneurs may encounter, contributing to their overall success and sustainability. Here's a breakdown of why these skills are essential:

Financial Management

Sustainable Business

Practices

Digital Marketing

Proficiency

Entrepreneurial

Leadership

Articlesfor you

PREVIOUS ASSOCIATIONS THAT HELPED TO GATHER EXPERIENCE

Jul 2013 - Till Today

$8b Micro Manoeuvre - To Survive, Payday Lenders Willing To Issue Low-Interest Loans

Blossom O’Meally-Nelson, chairman of the Jamaica Association for Microfinancing, or JAMFIN, says they are looking to source capital from the state at interest of 2 per cent or 3 per cent for onlending.

Typically, microfinancing companies, which are also known as payday lenders, price their loans at an annual rate of around 50-70 per cent, and higher, but the life of such loans are short term and usually counted in weeks, not years. If JAMFIN gets the Government to agree to wholesale funds to the sector at three per cent, O’Meally-Nelson said microlenders could in turn lend the funds to their clients at single-digit interest rates.

JAMFIN has been making the case that it has a role to play in helping with the recovery of the Jamaican economy. In an op-ed last week, O’Meally-Nelson noted that the sector is responsible for some $20 billion of loans revolving in the financial system – a suggestion that as a block their participation in the loan market packs substantial punch.Microfinance firms, whose loans are often unsecured and therefore high risk, have seen a spike in loan defaults since the pandemic, to the extent that both JAMFIN and the Jamaica Microfinancing Association, JamFA, say have been pushing some firms towards bankruptcy.

Jul 2013 - Till Today

May 2010 - Jun 2013

Winsome Leslie | Can Caribbean Microfinance Survive COVID-19

COVID-19 has been a global pandemic for several months now, with no end in sight, and the virus is wreaking havoc on economic and health systems. Small, open economies such as those in English-speaking Caribbean have been the hardest hit, disproportionately relative to the small number of confirmed cases – just over 1000 cases and less than 50 deaths as of May 25. How can the microfinance sector in the Caribbean navigate this crisis and seize the opportunity to promote the further development of the industry?

COVID19 comes in the wake of a series of hurricanes decimating the economies of several countries in the region, most recently in the Bahamas. The Inter-American Development Bank predicts an extremely bleak period ahead for the Caribbean, and certain reversal of the progress made by countries such as Jamaica in terms of external debt reduction and GDP growth.

As is the case elsewhere, Caribbean countries are working on two fronts to confront the crisis in real time, with no playbook. First, working to contain the virus, with stay-at-home orders, curfews and closing national borders, while at the same time working to save the economy. The decision of Caribbean governments to suddenly close national borders at the end of March has had a devastating impact on micro and small businesses, particularly those either directly or indirectly linked to the tourism industry, which accounts for 30 per cent to 40 per cent of GDP in some countries. Other businesses have been negatively affected by falling oil prices (Trinidad, Guyana) and abruptly interrupted supply chains. Both the scope and speed of the economic decline is unprecedented. In response, countries have unveiled various economic stimulus packages – including tax payment deferrals, low interest loans and grants – to keep businesses afloat, and help maintain employment – coupled in some cases with specific assistance to vulnerable populations.

March 2007 - Apr 2010

Blossom O’Meally-Nelson | Microfinance Can Aid COVID Recovery

It is estimated that the microfinance sector, or MFIs, accounts for approximately $20 billion of loans in circulation.

The key financing role played by these loan providers over the last three decades has been grossly understated.

Some regard the sector as a haven for ‘loan sharks’ and operations that abuse their customers by charging inordinately high interest rates and by carrying out draconian collections practices. This negative perception is so entrenched that the preamble to the draft Micro Credit Act reflected this bias.

This is an unfair and uninformed assessment which is based largely on isolated incidents. The fact is the majority of MFIs pursue best practices and attract multiple repeat customers.

Microfinance institutions are an important part of the growing financial space in Jamaica and the public has come to recognise that the sector boasts strong companies that have established themselves as sound financial institutions pursuing best practices according to international standards.

Two of the larger MFIs are listed on the Jamaica Stock Exchange.

Microfinancing is a highly competitive business and managing a microfinance company is no walk in the park, it demands constant attention and close and continuous scrutiny of loan performance. These companies do not take deposits, and unlike commercial banks they do not have the cushion of income derived from investing depositors’ money. They face constantly a high exposure to loan loss

March 2007 - Apr 2010

Jan 2005 - Feb 2007

JAMFIN CONVENES CAUCUS TO TACKLE DE-RISKING

The Jamaica Association of Micro Financing (JAMFIN) said it sees the de-risking policy being pursued by at least one commercial bank as a threat to bona fide micro finance companies that have been in business for years and have substantial lending portfolios.

Under the de-risking policy, commercial banks across the Caribbean have been closing the accounts of cambios, remittance companies and now micro finance companies, JAMFIN’s chair Blossom O’Meally-Nelson said in a release. It said commercial banks maintain that those are high-risk operations that open them up to substantial fines from regulators should there be any breach of anti-money laundering laws or laws against the financing of terrorism.

Correspondent banks mostly located in the United States act as clearing houses for funds that are in transit and they put pressure on commercial banks to get rid of accounts that they deem risky. “It is difficult to ignore the existence of a sub-theme here in that if these types of money services are crippled it means more business for the very commercial banks that are crying wolf,” O’Meally-Nelson said. The release said there are large numbers of ‘unbankable’ persons who use money services and to deprive them of the facility would serve to drive the informal economy.

TESTIMONIAL

I AM OKEY TODAY, BUT IN A YEAR WILL SEE ME, I'LL BE AMAZING